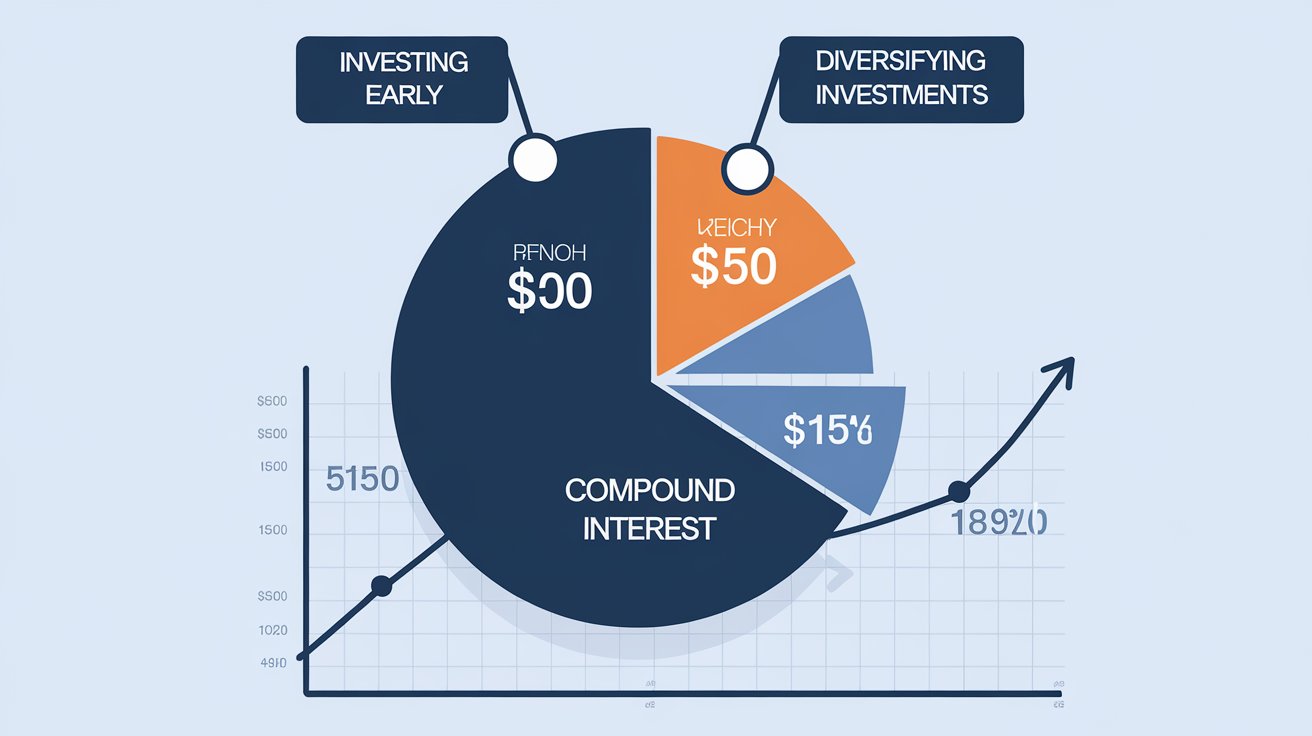

Compound interest is a powerful tool for building wealth over time. By reinvesting returns, investors can exponentially grow their wealth. Here’s how to harness compound interest for long-term financial success.

1. Start Early

Time is one of the most critical factors in compounding. The earlier you start investing, the longer your money has to grow, resulting in significant gains over time.

- Example: Investing $10,000 at an 8% annual return grows to over $46,000 in 20 years with compound interest.

2. Reinvest Returns

Reinvesting dividends and interest boosts compounding, as you earn returns on both your initial investment and previous gains. Dividend reinvestment plans (DRIPs) automatically reinvest dividends into additional shares.

3. Make Regular Contributions

Consistent contributions increase the principal amount, accelerating compounding growth. Even small, regular investments can lead to substantial wealth over the long term.

4. Choose High-Growth Investments

While conservative investments like bonds offer compounding, higher-growth assets like stocks typically generate greater long-term returns. Select investments that align with your risk tolerance and growth goals.

5. Minimize Fees and Taxes

Fees and taxes can eat into compounding gains. Choose low-cost investment options (like ETFs) and tax-efficient accounts (like IRAs) to maximize returns.

6. Be Patient and Avoid Withdrawals

Withdrawing from your investment disrupts compounding. Leave investments untouched for as long as possible to maximize growth. Patience is key to realizing the full benefits of compound interest.

By leveraging compound interest, making consistent contributions, and choosing growth-oriented investments, investors can steadily build wealth and achieve long-term financial security.